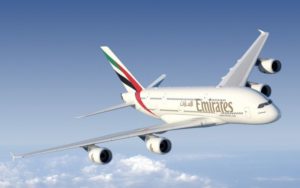

Foreign airlines have kept to their threat of withdrawing flight service to Nigeria if their trapped revenues were not repatriated, as Middle East mega carrier, Emirates Airlines, announced that it would suspend all flights to Nigeria from September 1, 2022.

Emirates is owed over $95 million in Nigeria, which it cannot repatriate due to scarcity of dollars and it was indicated that foreign airlines might increase their fares to Nigeria and subsequently withdraw their service to the Africa’s most populous nation.

THISDAY authoritatively learnt that other foreign carriers might soon withdraw their services, unless the federal government opens a discussion with them.

By end of July the amount of trapped funds, known as blocked fund, in Nigeria had risen to over $600 million and according to the International Air Transport Association (IATA), Nigeria has the highest blocked fund globally and its inability to pay the airlines is inhibiting economic recovery of these international carriers after the devastation of COVID-19.

Emirates in a statement announced that it was suspending all its flights from 1st of September, 2022 and disclosed that it had tried every avenue to address its ongoing challenges in repatriating funds from Nigeria, and has made considerable efforts to initiate dialogue with the relevant authorities for their urgent intervention to help find a viable solution but regrettably there has been no progress.

“Therefore, Emirates has taken the difficult decision to suspend all flights to and from Nigeria, effective 1 September 2022, to limit further losses and impact on our operational costs that continue to accumulate in the market. We sincerely regret the inconvenience caused to our customers, however the circumstances are beyond our control at this stage. We will be working to help impacted customers make alternative travel arrangements wherever possible,” the airline said.

The airline further hinted that if there be any positive developments in the coming days regarding Emirates’ blocked funds in Nigeria, it would re-evaluate our decision.

“We remain keen to serve Nigeria, and our operations provide much needed connectivity for Nigerian travellers, providing access to trade and tourism opportunities to Dubai, and to our broader network of over 130 destinations,” the airline added.

A fortnight ago, Emirates announced that it would reduce its flights to Nigeria from August 15 2022 due to its failure to repatriate its revenue earned from its ticket sales in Nigeria.

The airline said it would be forced to reduce flight from Dubai to Lagos from 11 times per week to seven times per week, saying that it did not have any choice but to take this action, to mitigate the continued losses Emirates was experiencing as a result of funds being blocked in Nigeria.

The airline made this known in a letter it wrote to the Nigerian Minister of Aviation, Senator Hadi Sirika, dated July 22 2020 and signed by Sheik Majid Al Mualla, the DSVP International Affairs.

The letter explained that as of July 2022, Emirates has $85 million of funds awaiting repatriation due to non availability of dollars in Nigeria and this figure has been rising by more than $10 million every month, as the ongoing operational costs of the airline’s 11 weekly flights to Lagos and five to Abuja continue to accumulate. The mega carrier said that the funds are urgently needed “to meet our operational costs and maintain the commercial viability of our services to Nigeria.”

“We simply cannot continue to operate at the current level in the face of mounting losses, especially in the challenging post COVID-19 climate. Emirates did try to stem the losses by proposing to pay for fuel in Nigeria in naira, which would have at least reduced one element of our on-going costs, however this request was denied by the supplier. This means that not only are Emirates’ revenues accumulating, we also have to send hard currency into Nigeria to sustain our own operations. Meanwhile, our revenues are out of reach and not even earning credit interest,” the letter said.

The airline also explained to the Minister that it took its management time before it arrived at the decision to cut down its flights to Nigeria.

“Indeed we have made every effort to work with the Central Bank of Nigeria (CBN) to find a solution to this issue. Our Senior Vice-President met with the Deputy Governor of the CBN in May and followed up on the meeting by letter to the Governor himself the following months, however, no positive response was received. Meetings were also held with Emirates’ own bank in Nigeria and in collaboration with IATA (the International Air Transport Association) to discuss improving FX allocation, but with limited success.”

The letter also said that despite Emirates considerable efforts, the situation continued to deteriorate.

The airline, however, emphasised that if the Minister would respond positively to its request of unlocking these funds for repatriation, it would re-evaluate its decision.

In June IATA disclosed the Nigeria owed foreign airlines $450 million representing 25 per cent of the total amount of international carriers’ funds held back by central banks of many countries put at $1.6 billion by end of April 2022.

Last week foreign airlines introduced new fares in their higher inventory, which increases economy ticket to average of N1 million and business class ticket from N4 million and these airlines include major international carriers like Air France, KLM, Delta Air Lines, Lufthansa, Qatar Airways, Emirates Airlines and others.

Round trip in later August, as indicated by the airlines sites, indicated that business class could go as high as over N12 million, while economy could go for over N3 million.

IATA said airfares charged by international carriers against Nigerian travellers are three times higher than what obtains in other countries that do not retain airlines’ revenues and expressed fear that the fares might continue to rise until Nigerians would not be able to afford international travel and that would eventually weaken the nation’s economy.

Reacting to the suspension of its flights to Nigeria, IATA state, “IATA is disappointed that the amount of airline money blocked from repatriation by the Nigerian government grew to $464 million in July. This is airline money and its repatriation is protected by international agreements in which Nigeria participates. IATA’s many warnings that failure to restore timely repatriation will hurt Nigeria with reduced air connectivity are proving true with the withdrawal of Emirates from the market. Airlines cannot be expected to fly if they cannot realize the revenue from ticket sales. Loss of air connectivity harms the local economy, hurts investor confidence, impacts jobs and peoples livelihoods. It’s time for the Government of Nigeria to prioritize the release of airline funds before more damage is done.”

The global body had said that if after introducing the higher fares and the airlines were unable to repatriate their revenues they might suspend flight operation to Nigeria.

President of National Association of Nigeria Travel Agencies (NANTA), Mrs. Susan Akporiaye told THISDAY in a telephone interview yesterday that what Emirates did was expected and warned that other international airlines like British Airways, Air France, Lufthansa, KLM, Turkish Airlines and others would withdraw their services, unless the federal government holds discussions with them.

She said that airlines are doing business and they ought to repatriate their earnings, but when the revenues are held back and there is no indication they would get their money, the natural reaction as a business is to reduce their flights in order to mitigate their losses and if there is no hope of getting their money they would pull out their service.

The NANTA President expressed surprise that the Minister of Aviation, Senator Hadi Sirika has not addressed the airlines and said that it is very important that the airlines are addressed, given hope on when they will get their money and also a timeline if all the monies would not be paid at once.

She also warned that if foreign airlines stopped operations to Nigeria it would be severely injurious to Nigeria’s economy because it means that foreign currency would stop coming in, foreign investment would stop coming in and at this critical time in Nigeria’s economy, such action would be deleterious to the nation.

“We need foreigners to keep coming because they bring in the needed dollars. If the airlines stopped flying to Nigeria that critical window will be closed. This will hurt our economy. The foreign airlines that bring people into our country provide us with liquidity, the foreign currency we need. So the airlines provide serious economic value to our country and help us get out of the current financial crisis.

“We need every foreign investment we can get. This is no the time to close this window; so government should do everything possible to make the airlines continue to fly to the country. What the federal government should do it to put the airlines on priority list for the distribution of dollars. Let them have their money and also assure them that their revenues would not be allowed to accumulate to a certain amount before they have it. If they get this assurance, they will calm down,” the NANTA President said.

Speaking in the same vein, former NANTA President and the Group Managing Director, Finchglow Holdings, Mr. Bankole Bernard called on the federal government to hold discussion with the foreign airlines and said that the international carriers fear that Nigeria might devalue the naira and this would lead to huge losses for them.

“It is very important that when things like this happen, there is room for communication especially from the government. In business, you will always have an exposure and the exposure is the fact that your money is tied down, but you know you are always going to get it because it is a credible country, but when your money is tied down and there is devaluation it will eventually lose value, then, the agitation will be more. That is why they (airlines) want to cut capacity because if you cut capacity, if the devaluation eventually happens, they will be able to cut their losses,” he said.